You know that moment at the end of the month when someone asks, “So how much did we make?” and suddenly your brain freezes? Especially when it is about payment reporting?

If you’re running an online business, leading a SaaS company, or managing an e-commerce store, your ability to answer that question quickly and accurately matters more than you think. And yet, for many businesses, financial reporting still feels like a guessing game. Spreadsheets everywhere. Multiple dashboards. One payment gateway says one thing, the bank says another. It’s chaotic. But here’s the truth: if you don’t have a clear view of your payment data, you’re not just flying blind. You’re also leaving money on the table.

That’s why we’re talking about payment reporting today. Let’s walk through the key metrics to track, how to make sense of your revenue data, and how a tool like Asyncpay can make all of it a lot easier.

What Key Payment Metrics Should You Be Tracking?

If you’re serious about optimizing your revenue, you need to keep an eye on more than just the total amount coming in. Here are the core metrics that give you a full picture of how your business is performing.

1. Total Revenue

This is the obvious one, but it’s the starting point. It shows how much money you’re bringing in over a set period. You’ll want to track this daily, weekly, or monthly depending on your business model.

2. Payment Success Rate

How many of your transactions go through on the first try? If this number is low, it might mean your payment system is glitchy, or you’re missing key payment options your customers prefer.

3. Refund and Chargeback Rates

A high refund or chargeback rate can be a sign of deeper issues. Maybe the product didn’t meet expectations, or maybe your payment process isn’t clear enough. Either way, it’s worth watching.

4. Average Transaction Value

This tells you how much people typically spend per order. It helps you identify opportunities to upsell, bundle products, or tweak pricing.

5. Recurring Revenue (if applicable)

If you run a subscription-based business, tracking monthly recurring revenue (MRR) or annual recurring revenue (ARR) is crucial. It helps you see growth patterns and spot churn early.

6. Payment Methods

Knowing how people prefer to pay, whether it’s cards, bank transfer, or mobile wallets, can help you optimize your checkout and reduce friction.

When these metrics are tracked properly, you’re no longer reacting to problems. You’re preventing them.

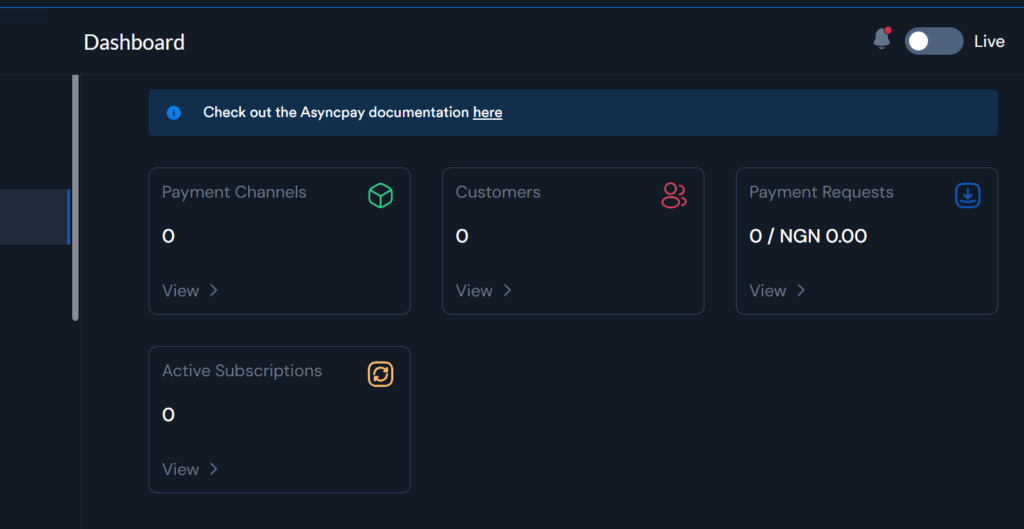

Asyncpay’s Dashboard Makes Financial Reporting Effortless

Now, let’s talk about what actually makes reporting stressful. It’s not just the numbers, it’s the juggling. One dashboard for Stripe. Another one for PayPal. A different one for your local gateway. And if you’re running multiple stores or managing client payments, the chaos multiplies. That’s where Asyncpay steps in.

Asyncpay’s dashboard brings all your payment activity into one clean, easy-to-read place. Whether you’re accepting payments through cards, mobile money, bank transfers, or a mix of everything, you can track it all from a single view.

Here’s what that looks like in real life:

You log in.

You see your total revenue for the week.

You check which payment methods are most popular.

You spot a slight dip in success rates and take action before it becomes a real problem.

You generate a report with one click and send it to your accountant. Done.

No need to bounce between tabs or chase missing data. Asyncpay helps you stay on top of your cash flow without the usual hassle.

Data-Backed Decisions: Forecasting Revenue with Better Insights

Tracking revenue is one thing. Using it to plan ahead is where the magic happens. When your payment data is organized and accurate, it becomes easier to answer important questions like:

- How much can we expect to earn next month?

- Which product or plan is performing best?

- Are we growing steadily, or just getting lucky some weeks?

Asyncpay helps you spot trends and patterns so you can make smarter decisions. You’re not just relying on vibes or gut feeling. You’re using real numbers. That helps you plan, budget, and scale with more confidence.

Whether you’re preparing for a launch, pitching to investors, or simply trying to stay ahead of your bills, being able to forecast your revenue accurately gives you peace of mind and better control over your business. Payment reporting doesn’t have to be a chore. When you know what to track and have the right tools in place, it becomes something powerful that helps you grow. You’ll catch problems early. You’ll double down on what’s working. And most importantly, you’ll finally feel like you’re in control of your revenue instead of constantly reacting to it.

Gain financial clarity with Asyncpay’s dashboard. Track the right metrics, simplify your reporting, and make better decisions without the spreadsheet headache.

👉 Get started now and see how Asyncpay can help your business stay on top of every naira, dollar, or cedi.